- #Financial budget workbook 2013 how to

- #Financial budget workbook 2013 pdf

- #Financial budget workbook 2013 full

- #Financial budget workbook 2013 free

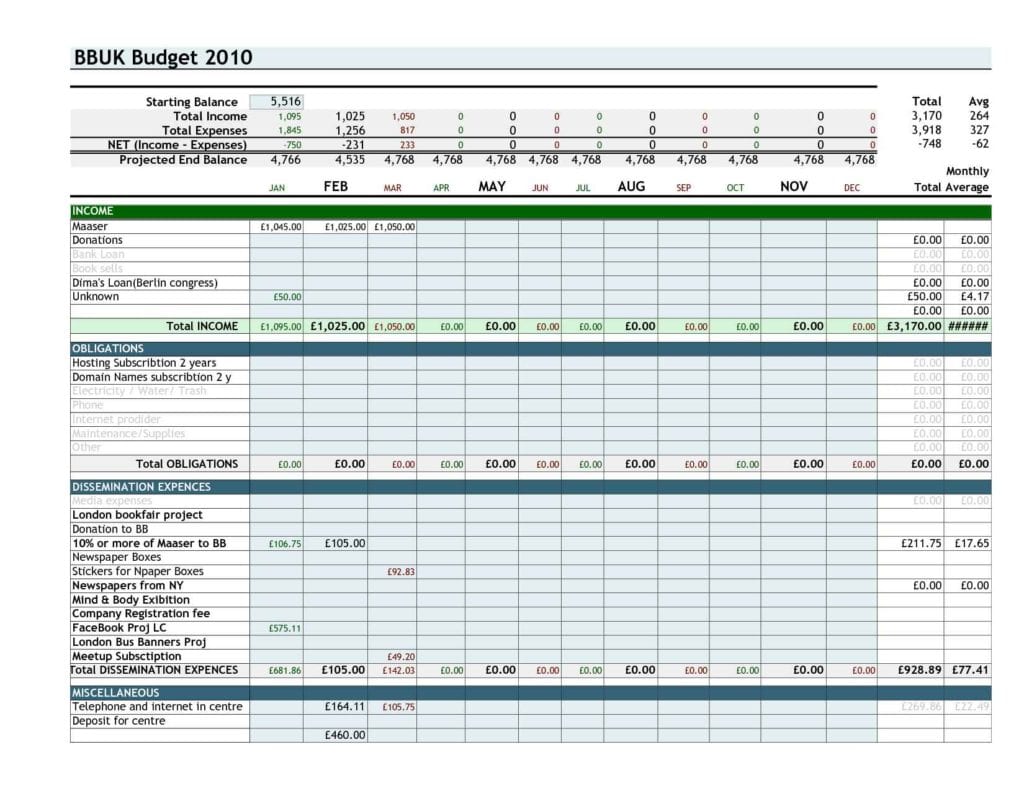

How much am I saving every month? How does that add to my net balance?.Am I spending more on any specific expense category over time?.How are my expenses trending over time?.

#Financial budget workbook 2013 free

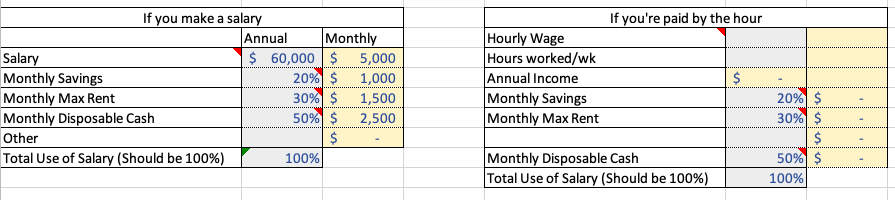

This is a simple free Personal Finance management excel template that focuses on making it easy for you to know what’s happening with your financial situation especially when you have multiple bank accounts, credit card accounts and cash. As you set up your next month’s budget, you can take a look at how the small decisions you make impact your finances six months down the road.Personal Finance Manager 2021 (Free Excel Budget template) But what I like best about PocketSmith is the future forecasting. This tool makes it easy to import your financial data and take a look at your spending habits across the board. You should also take a look at PocketSmith. Best of all, you can try it out for 34 days for free, which is more than enough time to see a difference in your budgeting habits.

#Financial budget workbook 2013 full

YNAB’s reporting tools will help you monitor how you’re doing and show you your full financial picture. You’ll simply set goals and log your spending throughout the month. If this spreadsheet doesn’t fit your needs, You Need A Budget (YNAB) has a more extensive budgeting solution that is sure to kick your budget into gear. Sticking to a budget is hard, but you’ve got this! Adjust the numbers and start fresh next month. Don’t get discouraged - If you do go over one month, don’t let it discourage you.Adjust as needed - If you need to spend more in one category, reduce the amount in another category to make sure you stay on track.Check in each week - Check in with your remaining totals at the start of each week and identify areas where you might need to cut back.If you miss a day, jump right back in the next day and log both days. Track your spending - Log your spending every day.Start each month with a review - At the beginning of the month, review the money you have for each category and adjust your spending accordingly.Here are a few tips to help you get started: Once you have your spreadsheet set up, it’s important to put it to work for you. Sound about right? Then this one-page, super-simple worksheet is for you. If you don’t want to spend a lot of time with your budget, sometimes all you need is a quick chart to jot down about what you’ll spend each month. xlsx, try right-clicking the link and selecting ‘Save Link As.’ĭownload for old versions of Excel 97-2003 (.xls) This spreadsheet for Excel 97-2003 or 2007 automatically calculates how much you have left to spend in your monthly budget categories as you input spending on a calendar-like grid. The original free budget spreadsheet (version 2)

The original free budget spreadsheet (version 2).Auto Loan Interest Calculator: Monthly Payment & Total Cost.

#Financial budget workbook 2013 pdf

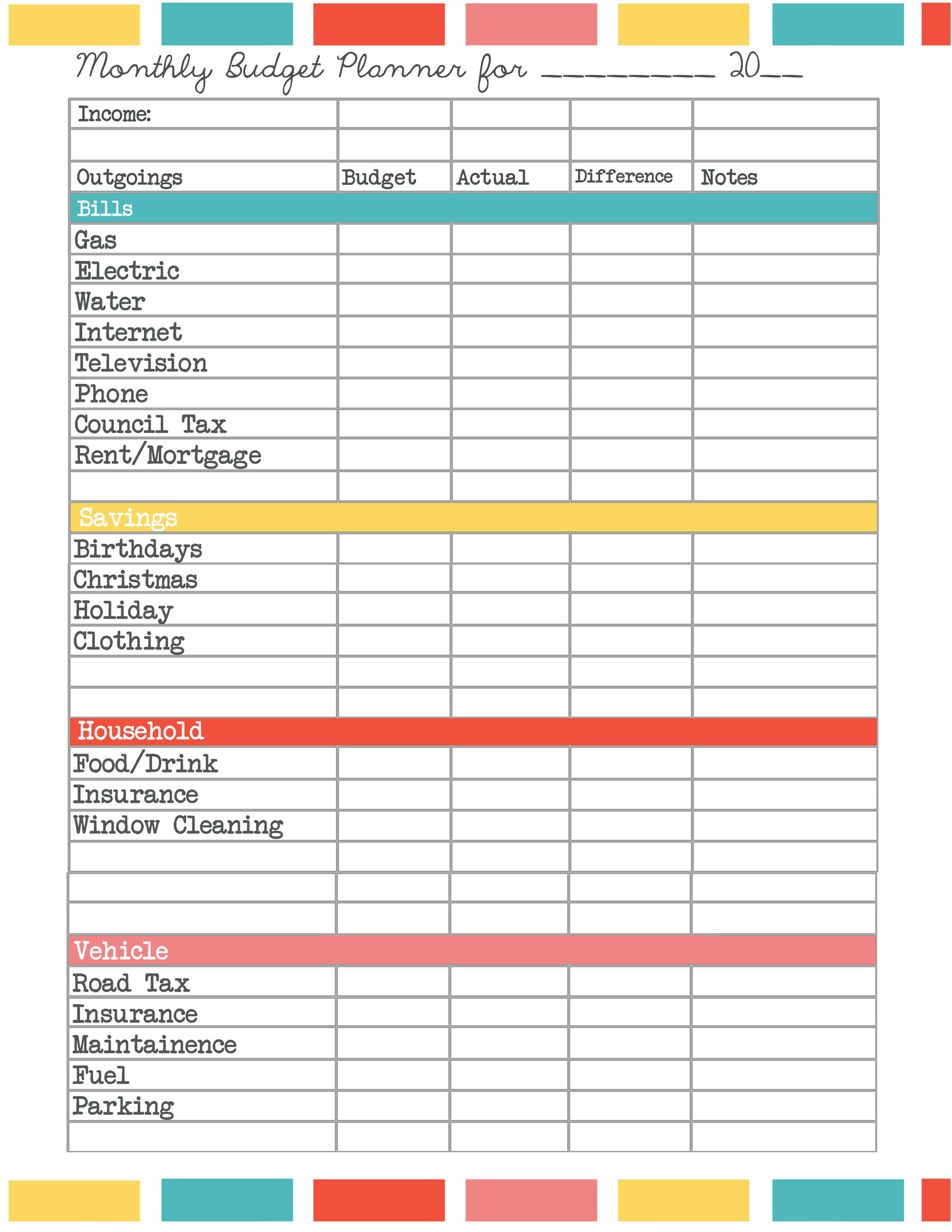

Free monthly budget spreadsheet for Excel & PDF.

#Financial budget workbook 2013 how to

0 kommentar(er)

0 kommentar(er)